Funding

SHEPP is a defined benefit pension plan, which means your benefit amount is determined by a formula based on eligible earnings and service. This defined benefit formula means that you can expect a predictable monthly income for life when you retire with a SHEPP pension.

Long-Term Funding Considerations

As a result, SHEPP must consider how it will fund benefit obligations that exist 70 or so years in the future as today's youngest members near the end of their lives. Funding is truly a long-term and ongoing consideration that requires careful monitoring to ensure SHEPP is securing member benefits now and into the future.

Funding Your Pension Benefit

Your SHEPP pension is funded through a combination of contributions and investment returns, which are referred to as the Plan's assets. SHEPP's liabilities are the benefit obligations we have to our members.

Monitoring the Plan's Funded Status

Funding a defined benefit pension plan to provide lifetime pensions requires careful oversight and monitoring. SHEPP's Board of Trustees regularly conduct an actuarial valuation to monitor the Plan's funded status and performance, ensuring member benefits remain secure over time. Since pension obligations are ongoing, the Plan's funding assessment is based on a going-concern basis, assuming operations continue indefinitely.

Under The Pension Benefits Act, 1992 (Saskatchewan), SHEPP must perform an actuarial valuation at least every three years. These valuations assess the Plan's assets and liabilities, determining whether there are sufficient funds to cover future benefit obligations. Valuations categorize the Plan's financial position as fully funded, in surplus, or with an unfunded liability. A pension plan is considered fully funded on a going-concern basis when it has enough assets to meet all current and future obligations.

SHEPP's Funding Policy

The Board has established a Funding Policy to guide its decision-making process, aimed at navigating the Plan through economic fluctuations and changing demographics while preserving the Plan's long-term financial integrity. The primary objective of the Funding Policy is to protect member benefits, with a secondary objective to stabilize contribution rates.

Margins for Benefit Security and Contribution Stability

Two separate and distinct margins, serve as essential tools for the Board to achieve its funding objectives: benefit security and contribution stability.

- Benefit Security Margin: Reflected in the balance sheet, this margin safeguards accrued benefits for Plan members.

- Contribution Stabilization Margin: This margin, integrated into the contribution rate, mitigates frequent rate fluctuations.

Together, these margins act as a safety net, ensuring the Plan's long-term sustainability.

Commitment to Long-Term Funding

Despite the prevailing uncertainty in the global economy over recent years, SHEPP's Board and Administration have remained committed to a sustainable, long-term funding strategy. The Board's diversified investment approach has demonstrated the Fund's capacity to deliver results and navigate short-term market disruptions, in contrast to the 2008 economic crisis. Recently, the Board has filed valuations more frequently, allowing for careful monitoring during financial market volatility.

Eliminating the Unfunded Liability

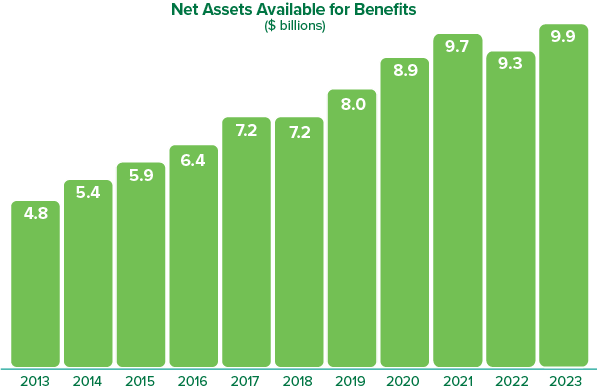

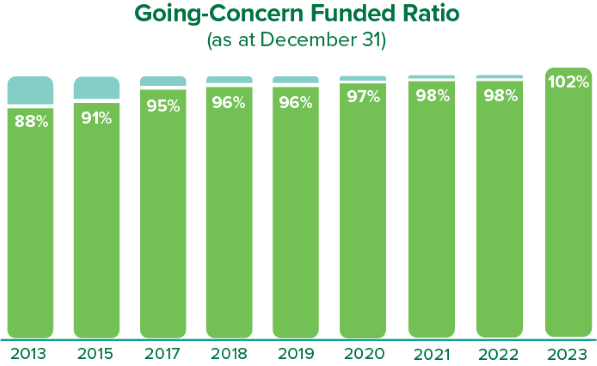

SHEPP has steadily improved its going-concern funded status since 2010, when the current unfunded liability was incurred as a direct result of the 2008 global financial crisis. The Board's long-term focus, funding strategy and investment policies, among other factors, enabled the Plan to make meaningful progress toward eliminating the funding deficit, which was fully amortized two years ahead of the legislated deadline of December 31, 2025.

SHEPP's Latest Valuation

In SHEPP's most recent valuation performed as at December 31, 2023, the Plan is fully funded at 102% on a going-concern basis. Strong investment returns accelerated funding progress, eliminating the going-concern unfunded liability incurred in 2010, resulting in a surplus of $228 million (from the $175 million deficit in 2022).

Contribution Rates

An actuarial valuation determines the combined employer and member contribution rates required to meet the Plan's going-concern funding requirements. As a result of SHEPP's valuation as at December 31, 2023, the combined contribution rate will be set at 16.5% of payroll (down from the current rate of 18.3%), effective January 1, 2025.

The cost of funding the Plan will continue to be shared between members and employers, maintaining the 1:1.12 ratio, with employers contributing $1.12 for every $1.00 contributed by members.

Please see the Understanding Your Pension Plan page for a breakdown of member and employer contribution rates.

Solvency

While SHEPP is exempt from funding the Plan on a solvency basis, we must still perform a solvency valuation. This is to determine a solvency ratio used in calculating current transfer deficiency holdbacks - the amount withheld from lump sum transfers until the Plan is fully funded on a solvency basis.

The latest valuation, as at December 31, 2023, confirms the Plan's solvency ratio is 100%, and therefore SHEPP is not currently required to apply a holdback to termination benefits and existing holdbacks will be released. SHEPP will arrange for the release of funds from existing holdbacks. The payment will be issued in the same manner as the initial transfer unless the member requests otherwise.

Our Funding Philosophy

The primary objective of the Board of Trustees' Funding Policy is to secure member benefits, and the secondary objective is to stabilize contribution rates. SHEPP's Board and Administration continue to work closely with the Plan actuary and investment consultant to manage investment risk and optimize the Fund's asset mix to ensure a sufficient rate of return without exposing the Plan and its members to excessive volatility.

With this policy in place, the Fund has more than doubled between 2014 and 2024 from $5.4 billion to $11.1 billion.