Understanding Your Retirement Benefit

SHEPP is a defined benefit plan, which means your pension is determined by a formula based on your highest average contributory earnings and credited service. This means as your average contributory earnings and years of credited service grow, so does your pension.

When can I retire?

Retirement eligibility is determined based on your age and years of service.

- Normal Retirement: Normal retirement is the first day of the month that coincides with or immediately follows your 65th birthday.

- Early Retirement (unreduced pension): You can retire with an unreduced pension as soon as your age and years of credited service add up to 80 or more. You will also be eligible to receive a bridge benefit, payable from retirement to age 65.

- Early Retirement (reduced pension): You can retire with a reduced pension any time after age 55 with at least two years of service. The reduction applied will depend on your pensionable service.

- Postponed retirement: You must begin collecting your pension by December 1st of the year in which you reach age 71.

How is my pension calculated?

When you retire, you are entitled to a monthly pension benefit, which you will receive for life.

There are two factors used in your pension calculation which determine the amount you will receive:

- Your contributory earnings; and

- Your years of credited service.

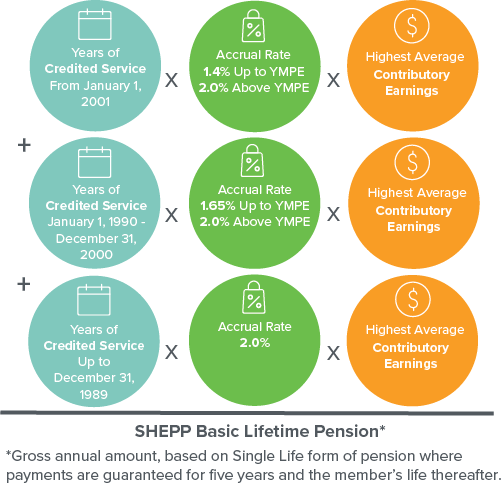

The benefit formula used to determine your accrued lifetime pension is:

Click here to find the current YMPE.

How much will my pension be when I retire?

Normal Retirement

Every member is eligible to retire with an unreduced pension on the first day of the month that coincides with or immediately follows their 65th birthday. At normal retirement you are entitled to your basic lifetime pension as calculated using the accrued lifetime pension benefit formula.

Early Retirement (Unreduced)

You can retire with an unreduced pension as soon as your age and years of credited service add up to 80 years.

In addition to your basic lifetime pension, you will receive a bridge benefit until age 65. The bridge benefit is designed to supplement your basic lifetime SHEPP pension until age 65, when CPP benefits normally begin.

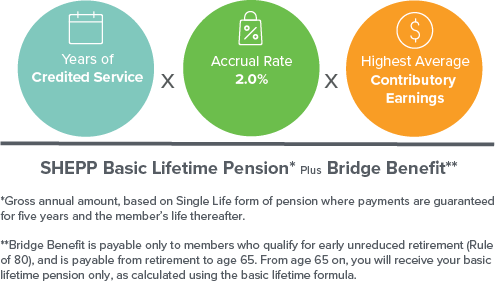

From your early retirement age to age 65, your basic lifetime pension plus the bridge benefit is calculated as:

Early Retirement (reduced pension)

You can retire early with a reduced pension any time after age 55 with at least two years of service. The reduction applied to your pension depends on your pensionable service.

Ten or More Years of Pensionable Service If on the date you terminate employment and Plan membership you are 55 years of age or older, but less than 65 years of age, and you have 10 or more years of pensionable service, you are entitled to your accrued lifetime pension reduced by 3% multiplied by the lesser of:

- the number of years that you are short of age 65;

- the number of years by which your age plus credited service is short of 80 years; and

- the number of years that you are short of age 62 or 20 years of credited service (whichever is greater).

Fewer Than 10 Years of Pensionable Service If you have fewer than 10 years of pensionable service, your pension is reduced on an actuarial basis. This means your reduced pension is the actuarial equivalent of the pension payable starting at age 65.

Postponed Retirement

You can retire as late as December 1st of the year in which you reach age 71 and will be entitled to your basic lifetime pension as calculated using the accrued lifetime pension benefit formula.

For more information and example calculations refer to the Plan Booklet.

How can I estimate what my future pension benefit will be?

- Your Annual Pension Statement

- Online Pension Calculator

You will find a pension projection on your Annual Pension Statement which is mailed to you each spring. The Annual Pension Statement provides a snapshot of your pension benefits as of December 31 of the preceding year, including an estimate of your future pension at normal retirement date, and upon early (unreduced) retirement if you are eligible.

Sign in to SHEPPweb and use the online Pension Projection Calculator to estimate your future pension benefit. Using this calculator, you can perform unlimited pension projection calculations to help you determine when your milestone dates will occur (e.g. rule of 80) and what your pension benefit would look like based on your expected earnings and service. Pension estimates performed using the online calculator include projections for normal form and optional forms of pension available to you based on your marital status according to our records. Watch the How to Estimate Your Pension video on the Video Tutorials page for help using this calculator.

If you haven't signed in to SHEPPweb before, visit the Getting started with SHEPPweb page for help.

What if I have more than one SHEPP employer?

If you were employed by two or more participating employers in a year, the Plan does not require the employers to recognise your pensionable earnings with any other employer when determining the member and participating employer contributions due to the Plan. Therefore, if you participate in the Plan with more than one participating employer or you change from one employer to another in a year, your contributory earnings in that year may be lower than the pensionable earnings in that year.

If the year in question is one of your HACE years, your SHEPP pension benefit may be impacted. For more information please contact SHEPP.

What are 'forms' of pension?

Pensions come in different shapes and sizes - called 'forms'. This means you can tailor your pension to meet your particular needs. You are not required to choose a form of pension until you are ready to retire and are completing the required forms.

Are there other Plan Benefits?

Click on any of the links below to learn more about the following Plan benefits: