The History of SHEPP

SHEPP's mission, vision and values are born out of over 60 years of pension administration in Saskatchewan. What started as a modest retirement plan in 1962 - just months before Saskatchewan signed Medicare into law - has flourished into the largest defined benefit pension plan and the only industry-wide pension plan for healthcare workers in the province. Below is a detailed history of the Plan and some of the key moments that have helped to define what SHEPP is today. However, the Quick Reference Guide to SHEPP's History provides information on the Plan's history at a glance.

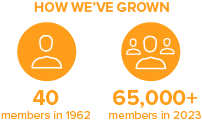

The Plan has had a number of names over the years, but it first began on March 1st, 1962 as "The Retirement Plan for Employees of Contributing Members Hospitals and Allied Organizations of the Saskatchewan Hospital Association" and was administered by the Saskatchewan Hospitals Association. At the time, just 40 full-time healthcare employees were eligible to join the Plan, and contribution rates were set at 5 percent.

The Plan has had a number of names over the years, but it first began on March 1st, 1962 as "The Retirement Plan for Employees of Contributing Members Hospitals and Allied Organizations of the Saskatchewan Hospital Association" and was administered by the Saskatchewan Hospitals Association. At the time, just 40 full-time healthcare employees were eligible to join the Plan, and contribution rates were set at 5 percent.

Over the next 14 years, the Plan would grow in membership. In 1970, the Plan Text was changed to allow permanent part-time employees to enrol. And in 1973, both the Royal University and Pasqua Hospitals joined the Plan. By 1976 as public coverage for health service was expanding outside of hospitals and into care homes and other healthcare centres, the Plan changed hands and administration was handed over to the Saskatchewan Health-Care Association. The Plan was aptly renamed the SHA Retirement Plan.

In the 1980s, governments began to understand how important pensions would be as the baby boomer generation retired, which resulted in major changes to the pension landscape. In 1981, the maximum enrolment age changed from 55 to 64. A year later, changes were made to The Pension Benefits Act, 1992 (Saskatchewan) that would require members with spouses to choose a joint life form of pension. This helped to protect a member's spouse from losing a significant portion of their household income when the member passed away, ensuring they received a portion of the member's pension after their death. In 1986, a Plan surplus led to a change in the minimum retirement and "The Rule of 80" was introduced into the Plan Text which enabled members to retire with an unreduced pension as long as their age and years of credited service added up to 80 or more. Voluntary contributions were also disallowed while the concept of prior service was introduced to allow members to purchase uncredited service. And in 1987, the provincial government began funding pensions for special care home workers who wholly joined the Plan.

In the 1980s, governments began to understand how important pensions would be as the baby boomer generation retired, which resulted in major changes to the pension landscape. In 1981, the maximum enrolment age changed from 55 to 64. A year later, changes were made to The Pension Benefits Act, 1992 (Saskatchewan) that would require members with spouses to choose a joint life form of pension. This helped to protect a member's spouse from losing a significant portion of their household income when the member passed away, ensuring they received a portion of the member's pension after their death. In 1986, a Plan surplus led to a change in the minimum retirement and "The Rule of 80" was introduced into the Plan Text which enabled members to retire with an unreduced pension as long as their age and years of credited service added up to 80 or more. Voluntary contributions were also disallowed while the concept of prior service was introduced to allow members to purchase uncredited service. And in 1987, the provincial government began funding pensions for special care home workers who wholly joined the Plan.

The 1990s were a decade of immense change for healthcare in Saskatchewan and pensions across the country. Pension adjustments were introduced as law by the federal government to even the playing field for Canadians tax-sheltering savings for retirement purposes. The Government of Canada also changed the "locking-in rule" to two years of service rather than when age plus continuous service totaled 45, meaning you couldn't directly withdraw your pension contributions after two years of service.

But it wasn't just the federal government's rule changes that were affecting the pension landscape. The Government of Saskatchewan was also reorganizing the healthcare system to better utilize other primary healthcare services than just hospitals and physicians. This resulted in some small changes, like homecare employees receiving pension funding in 1991 and joining the Plan en masse. Saskatoon City Hospital also transferred 900 employees into the Plan in 1994. But it also resulted in some bigger structural changes. In 1993, the Health Districts Act consolidated individual health boards across the province into 8 districts, which reduced the number of employers involved with the Plan from over 200 to 120. The province also devolved over 2,000 employees from executive government, all of whom were given the choice to join the Plan. Around 400 of them did so.

But it wasn't just the federal government's rule changes that were affecting the pension landscape. The Government of Saskatchewan was also reorganizing the healthcare system to better utilize other primary healthcare services than just hospitals and physicians. This resulted in some small changes, like homecare employees receiving pension funding in 1991 and joining the Plan en masse. Saskatoon City Hospital also transferred 900 employees into the Plan in 1994. But it also resulted in some bigger structural changes. In 1993, the Health Districts Act consolidated individual health boards across the province into 8 districts, which reduced the number of employers involved with the Plan from over 200 to 120. The province also devolved over 2,000 employees from executive government, all of whom were given the choice to join the Plan. Around 400 of them did so.

But perhaps the change with the most impact to the Plan during that period was the decision to amalgamate three major healthcare associations into one. In 1993, the Saskatchewan Health-Care Association, the Saskatchewan Association of Special Care Homes and the Saskatchewan Home Care Association all joined to form the Saskatchewan Association of Health Organizations (SAHO). As a result, the Plan was renamed the SAHO Retirement Plan and membership was extended to employees of SAHO employers, including various agencies and associations that provided health education and regulation services in the province.

Meanwhile, significant benefit improvements were being made. The "Bridge Benefit" was introduced in 1992 for members who met the Rule of 80 (age plus years of credited service equals 80 or more) and retire before age 65. It was designed to supplement their retirement income between early retirement and age 65. In 1993, casual and temporary employees became eligible to join the Plan upon meeting minimum requirements.

The latter half of the decade and the beginning of the 21st Century offered further changes to the Plan. Because the Plan had a surplus in 1990, and the Income Tax Act limits the amount of surplus a pension plan can carry, a number of significant benefit improvements were made. Previously, the Plan had used the five-year highest average earnings to calculate pension amounts, but that was changed to four years. The minimum age requirement of 55 was removed from the Rule of 80 to allow members to retire even earlier. And finally, the formula was changed to offer a full two percent accrual on pre-1990 service. In 2001, more amendments were made that changed the lifetime pension benefit formula to a 1.65% and 2% step rate accrual for service between 1990 and 2000.

The latter half of the decade and the beginning of the 21st Century offered further changes to the Plan. Because the Plan had a surplus in 1990, and the Income Tax Act limits the amount of surplus a pension plan can carry, a number of significant benefit improvements were made. Previously, the Plan had used the five-year highest average earnings to calculate pension amounts, but that was changed to four years. The minimum age requirement of 55 was removed from the Rule of 80 to allow members to retire even earlier. And finally, the formula was changed to offer a full two percent accrual on pre-1990 service. In 2001, more amendments were made that changed the lifetime pension benefit formula to a 1.65% and 2% step rate accrual for service between 1990 and 2000.

Meanwhile, the Plan itself was going through a restructuring as a result of the SAHO amalgamation. SAHO began meeting with six major healthcare unions in the province and signed an agreement in principle to jointly trustee the Plan in 1998. Over the next 4 years, SAHO and the six member unions would further define the principles under which the Plan would be jointly trusteed. And in 2002, an Agreement and Declaration of Trust was signed and the Plan was renamed the Saskatchewan Healthcare Employee's Pension Plan (SHEPP). Until then, decisions on how both the Plan and the Fund were administered were governed by SAHO alone. But the agreement significantly impacted the Plan as it became jointly governed by a Union Partner Committee and an Employer Partner committee, and administered by a Board of Trustees equally represented by employees and employers.

Since then, SHEPP has moved into its own independent space; first on Henderson Drive and then to its current location on Parliament Avenue in Regina. SAHO has since transferred services to 3sHealth, and labour relations and collective bargaining to a new entity: SAHO Inc.

Over 60 years after the Plan's inauguration, SHEPP has expanded considerably from its time as a 40-member pension plan. Today, SHEPP is the largest defined benefit pension plan in the province and the only industry-wide pension for healthcare employees in Saskatchewan.